Online

Start Date

Part-Time:

These courses are being reviewed and updated. They will be offered again in 2024.

The Certified Financial Planner (CFP) courses are designed to help professionals in the financial services industry learn the fundamentals of building a comprehensive financial plan. These are the first step towards attaining CFP designation with FP Canada (formerly the Financial Planning Standards Council).

The CFP® Certified Financial Planner courses at Ashton College are offered in partnership with Advocis. These courses are also an FP Canada-accredited Core and advanced Curriculum. The Core Curriculum is mandatory education for those looking to achieve the QAFP designation or take their first step towards achieving their CFP designation. After completing the Core Curriculum, CFP candidates must then complete the Advanced Curriculum to get their designation.

If you’re interested in applying for the QAFP or CFP certifications, but already have relevant financial or equivalent professional qualifications, you may be able to pursue a faster path to CFP certification.

If you hold relevant designations or licences, you may be exempted from taking some of the components of FP Canada’s Core Curriculum and Advanced Curriculum.

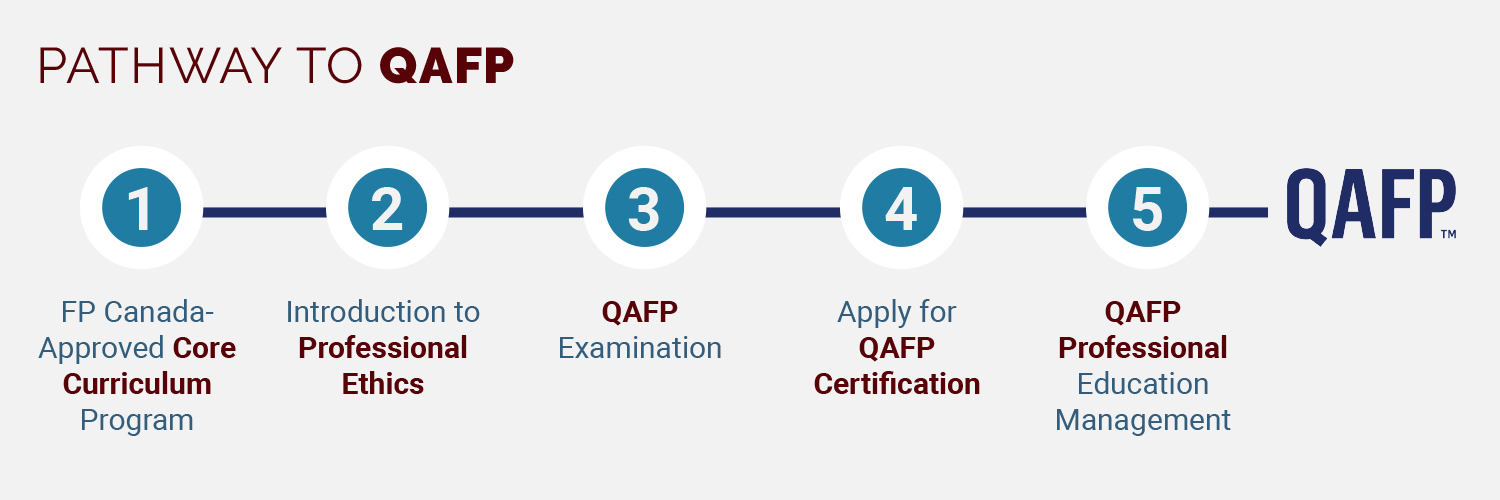

QAFP certification demonstrates a financial planner’s competence and commitment to the highest ethical standards of responsibility. QAFP professionals have demonstrated the knowledge, skills, experience and ethics required to provide holistic financial planning strategies and solutions for average Canadians with typical financial planning needs.

The QAFP designation presents a certification option for financial planners wishing to serve a broad market, or for those wishing to gain recognition for their qualifications and professionalism along the path to CFP® certification. QAFP professionals enable a broad population of Canadians to access the professional financial planning advice they need. They play an important role in helping their clients begin the journey to living life with confidence.

To obtain the QAFP designation, candidates must complete a rigorous education program, pass a national exam and demonstrate one year of qualifying work experience. To maintain certification, QAFP professionals must keep their knowledge and skills current by completing 12 hours of continuing education each year. They must also adhere to FP Canada Standards Council™ Standards of Professional Responsibility, including a Code of Ethics which mandates that QAFP professionals place their clients’ interests first. The Standards Council vigilantly enforces these standards.

The Certified Financial Planner designation is the most widely recognized financial planning designation in Canada and worldwide. A CFP designation assures Canadians that the design of their financial future rests with a professional who will put their clients’ interests ahead of their own.

There are approximately 17,000 CFP professionals across Canada, part of an international network of more than 175,000 CFP professionals around the world.

CFP certification is considered the worldwide standard for the financial planning profession. CFP professionals have demonstrated the knowledge, skills, experience and ethics to examine their clients’ entire financial picture, at the highest level of complexity required of the profession, and work with their clients to build a financial plan so that they can “Live Life Confidently™.”

To obtain the CFP designation, candidates must complete a rigorous education program, pass a national exam and demonstrate three years of qualifying work experience. To maintain certification, CFP professionals must keep their knowledge and skills current by completing 25 hours of continuing education each year. They must also adhere to the FP Canada Standards Council™ Standards of Professional Responsibility, including a Code of Ethics which mandates that CFP professionals place their clients’ interests first. The Standards Council vigilantly enforces these standards.

None

This course introduces the fundamental knowledge required by candidates to articulate their professional responsibilities as financial planning professionals. The module is designed to provide candidates with a detailed understanding of the financial services industry, including the role of regulatory and oversight bodies in the areas of insurance and securities and mutual funds. It also explores the concepts and principles of consumer protection from financial institutions and financial services professionals.

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of the time value of money and financial statements for individuals and businesses, as required by candidates in their role as financial planners. It provides candidates with the knowledge they need to clearly document, analyze, project and present financial information as it relates to the goals, needs, and priorities of individuals and businesses. The module exposes candidates to key topics such as how to make financial projections to determine whether goals are achievable and how to evaluate the impact individuals’ and businesses’ current and projected cash flow may have on their ability to meet financial goals.

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course introduces the fundamental knowledge required by candidates to articulate their professional responsibilities as financial planning professionals. This module introduces key knowledge financial planners require to determine the appropriate credit facilities that will help individuals achieve their objectives. The module explores methods for repaying debt — in particular, how various strategic changes affect cash flow, amortization, debt levels and a client’s ability to achieve goals. The module further discusses how to assess the creditworthiness of an individual in support of recommending effective credit and debt solutions to clients. The module also addresses appropriate strategies and options to help financial planners assist insolvent and delinquent debtors.

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of registered retirement savings and income plans. It provides candidates with the knowledge they need to evaluate and recommend tax-efficient wealth accumulation and decumulation strategies that will aid individuals in reaching their retirement

goals.

Students who have previously taken FP243 Retirement Income Planning will have earned equivalency for this module.

This course explores how Financial Services professionals are expected to possess detailed knowledge related to the eligibility for benefits available, as well as factors to consider in evaluating decisions to apply for and commence benefits available to individuals through Canada’s government benefit programs (including the Canada Pension Plan, Old Age Security, Employment Insurance and the Canada Child Benefit).

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of Registered Education Savings Plans (RESP) and Registered Disability Savings Plans (RDSP). It provides candidates with the knowledge to evaluate and recommend optimal strategies to achieve education-related goals and goals for individuals with a disability.

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of economics as they relate to the knowledge required by candidates in their role as financial planners. It is designed to provide candidates with a detailed understanding of the Canadian economy.

Students who have previously taken FP241 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals to creating an appropriate asset allocation for an individual given their investment objectives and constraints (including return expectations and willingness, capacity and need for risk) and evaluating investments that are suitable for the individual. It is designed to provide candidates with a detailed understanding of the topic and enable them to interpret the return and risk of an individual’s investment portfolio, as well as help an individual make sense of their investment statements, including the impact that changing investment values may have on achieving their goals.

Students who have previously taken FP242 Taxation & Investment Planning, will have earned equivalency for this module.

This course introduces the fundamental knowledge required by candidates to articulate their professional responsibilities as financial planning professionals. This module addresses the key knowledge candidates require to understand and interpret an individual’s tax profile, including being able to explain and identify the income tax rules, as well as the implications for various types of income. The module also explores tax deductions and credits, as well as the benefits of engaging in income splitting.

This course explores the fundamentals of the Canadian legal system and will provide financial planners with a good understanding of the constitutional division of powers, as well as the main legal rules that apply to the delivery of financial services. The module further examines the concepts of property rights, wills and powers of attorney. It evaluates the different types of business ownership structures with respect to their characteristics, benefits and drawbacks. The module also provides candidates with an in-depth knowledge of the fundamentals of estate planning.

Students who have previously taken FP244 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of property and casualty insurance products, government and private health care insurance plans and creditor insurance. It provides candidates with the knowledge to estimate the life and disability insurance needs for an individual, as well as understanding the importance of the common contractual terms contained within life and disability insurance policies.

Students who have previously taken FP244 Financial Planning Foundations will have earned equivalency for this module.

This course explores the fundamentals of human behaviour — in particular, how the brain works as it relates to decision-making. It provides candidates with a detailed understanding of values, heuristics, emotions and disorders related to money that may affect the decision-making process. Knowing how to influence human behaviour is essential to helping clients benefit from financial planning.

This course builds on the knowledge presented in the 12 modules that make up the Advocis Core Curriculum Program for QAFP and CFP Certification. The purpose of this course is to present the content and material required for the advanced knowledge topics found in the FP Canada Body of Knowledge.

Subject to change without notice

Steve is a (CFP) Certified Financial Planner and a Certified Health Insurance Specialist (CHS). He has also completed the Certified Executive Coach program at Royal Roads University. He combines his 20 years of industry experience with his passion for education and the development of others. Steve is an Advanced Case Consultant for Canada Life where he works alongside financial advisors as their subject matter expert on life insurance. His focus is on estate planning and corporate insurance planning where he combines his product design and people skills to create custom solutions for clients.

Robert Hurdman, Certified Financial Planner (CFP), has worked as a financial advisor in Calgary, AB, for eight years. Robert gives professional advice to families on financial planning and investment management. Besides the Certified Financial Planner designation, Robert obtained a B.A. in International Studies from Laval University and a Master of Education from the University of Calgary. He also volunteers in his community with Junior Achievement, Scouts Canada, YMCA, and in his church.

Robert Hurdman, Certified Financial Planner (CFP), has worked as a financial advisor in Calgary, AB, for eight years. Robert gives professional advice to families on financial planning and investment management. Besides the Certified Financial Planner designation, Robert obtained a B.A. in International Studies from Laval University and a Master of Education from the University of Calgary. He also volunteers in his community with Junior Achievement, Scouts Canada, YMCA, and in his church.

Jeff McCartney has 25 years of experience working in financial services; a significant amount of that time was spent as a retail investment advisor and financial planner with Canada’s largest financial institutions. In 2017, Jeff began his second career as an instructor and educator, teaching various financial planning and business-related courses at two well-known Canadian colleges. At the same time, he also launched Forward Looking Financial Solutions, a financial planning firm devoted to helping people in transition.

Jeff McCartney has 25 years of experience working in financial services; a significant amount of that time was spent as a retail investment advisor and financial planner with Canada’s largest financial institutions. In 2017, Jeff began his second career as an instructor and educator, teaching various financial planning and business-related courses at two well-known Canadian colleges. At the same time, he also launched Forward Looking Financial Solutions, a financial planning firm devoted to helping people in transition.

Jeff also acts as a consultant and content expert; writing articles, developing podcasts, and providing educational subject matter and financial insights to various organizations across the country.

Jeff was awarded the Certified Financial Planner (CFP) designation in January 2000; the Chartered Financial Divorce Specialist (CFDS) designation in 2017; and has completed numerous professional courses and programs along the way including the Life License Qualification Program (LLQP). Jeff has a BA in Economics and Finance from the University of Western Ontario and a Diploma in Accounting from Wilfrid Laurier University.

Grant Strachan is an accomplished Senior Financial Consultant and Branch Manager for one of the largest Financial Planning Companies in Canada. He holds the Certified Financial Planner (CFP), Chartered Life Underwriter (CLU), and Registered Retirement Consultant (RRC) designations and has both a Bachelor’s and Master’s Degree. For ten years, Grant has managed his own practice where he and his team actively manage a client base of High Net Worth professionals and business owners. Grant is passionate about developing comprehensive financial plans to give his clients the confidence they are on track to achieve their financial goals by focusing on advanced Tax and Estate planning strategies. He also holds his Life License so he can address the full scope of his clients’ needs. Grant regularly presents retirement planning workshops for the Government of Canada and the BC Teachers Federation.

Grant Strachan is an accomplished Senior Financial Consultant and Branch Manager for one of the largest Financial Planning Companies in Canada. He holds the Certified Financial Planner (CFP), Chartered Life Underwriter (CLU), and Registered Retirement Consultant (RRC) designations and has both a Bachelor’s and Master’s Degree. For ten years, Grant has managed his own practice where he and his team actively manage a client base of High Net Worth professionals and business owners. Grant is passionate about developing comprehensive financial plans to give his clients the confidence they are on track to achieve their financial goals by focusing on advanced Tax and Estate planning strategies. He also holds his Life License so he can address the full scope of his clients’ needs. Grant regularly presents retirement planning workshops for the Government of Canada and the BC Teachers Federation.

Jason Wong has extensive knowledge in the wealth management industry and has been practising financial planning since 2001. Jason started his career through the financial advisory channel in one of the major banks. He then moved on to the independent channel to assist his individual and business clients in achieving their financial goals through comprehensive financial planning. Jason is also a consultant supporting financial advisers in providing wealth management solutions to their clients. Jason holds several industry accreditations: Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), Financial Management Advisor (FMA) and Derivative Market Specialist (DMS). He holds a Master of Business Administration from the University of Manchester, one of the top global business schools according to the Financial Times Global MBA rankings.

Jason Wong has extensive knowledge in the wealth management industry and has been practising financial planning since 2001. Jason started his career through the financial advisory channel in one of the major banks. He then moved on to the independent channel to assist his individual and business clients in achieving their financial goals through comprehensive financial planning. Jason is also a consultant supporting financial advisers in providing wealth management solutions to their clients. Jason holds several industry accreditations: Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), Financial Management Advisor (FMA) and Derivative Market Specialist (DMS). He holds a Master of Business Administration from the University of Manchester, one of the top global business schools according to the Financial Times Global MBA rankings.

Live Online Students

Ashton College offers education for all students with a unique online learning approach. A synchronous learning component provides real time interaction and immediate feedback. We use real time interactive sessions, breakout rooms, and screen-sharing. An asynchronous learning component allows students to work at their own pace. Our asynchronous learning materials include recorded real time lectures, online readings, and discussion forums. We encourage students, if possible, to use both components so as to enjoy interactivity and community of real-time learning as well as studying at their own pace. This approach ensures students have support and resources to achieve their educational goals.

For synchronous sessions, students need to have a fully functional computer system with a webcam, speakers and microphone or headset and headphones, along with a reliable high-speed internet connection. Though the classes can be accessed using smartphones and tablets, we recommend using a laptop or desktop computer for a better learning experience.

This program/course does not require approval by the Private Training Institutions Branch (PTIB) of the Ministry of Post-Secondary Education and Future Skills. As such, PTIB did not review the program/course.