Enter your email below to receive weekly updates from the Ashton College blog straight to your inbox.

By: Mandeep Bedi

Published On: April 7, 2017The journey to CFP certification primarily hovers around the 4 E’s: Education, Exam, Experience and Ethics. Besides enabling professionals to align with their clients’ needs more closely, CFP certification also enables aspiring financial planners to keep up with the financial services industry standards.

In Canada, Financial Standards Planning Council (FPSC) is the certification body that sets professional standards for the CFP courses and practising professionals. CFP certification is not a one-time affair: it is a commitment to excellence in financial services consulting that requires candidates to go through an extensive education program, pass two national exams, have 3 years of qualifying work experience and complete new professional education courses every year, in addition to adhering to the ‘Standards of Professional Responsibility for CFP Professionals and FPSC Level 1 Certificants in Financial Planning’.

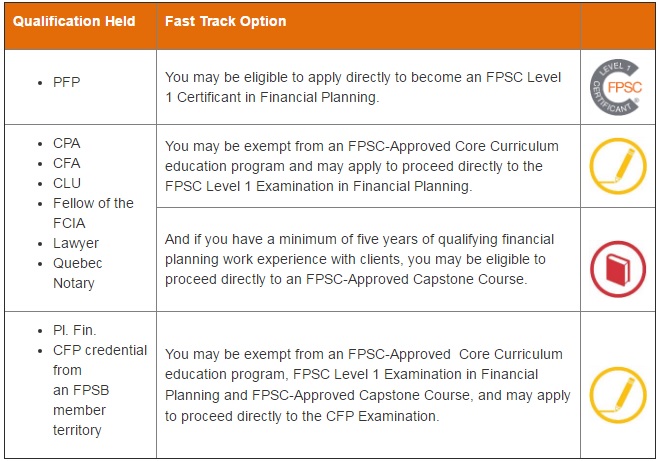

For those candidates who have certain designated financial planning or professional qualifications, exemptions could be made to fast track the CFP Certification process. FPSC’s website spells it out as shown in the table below:

Attaining a CFP designation involves various steps that require skill and dedication to inch forward on the certification path. Let’s recapitulate those steps, as outlined on the FPSC website page.

The first step towards CFP designation is education. Joining an FPSC approved education program that takes you through the core curriculum. In case you are wondering where to find the education providers, FPSC has a comprehensive list of all accredited ones on their website page.

The core curriculum includes four courses:

Step two is taking an FPSC Level 1® Examination in Financial Planning. This is your first exam on the path to CFP certification. The exam is electronically administered and can be taken at an authorized computer-based testing centre in Canada. It is conducted in both official languages and happens two times in a year. The duration of exam is 4 hours, and it consists of 95 multiple choice questions. The study material from FPSC can be found on this link.

The next step is FPSC Level 1® Certification in Financial Planning. In addition to registering for the FPSC Level 1® Examination, you also need to apply for your FPSC Level 1® Certification. While you can start financial planning consulting for clients with simple financial planning requirements, as soon as you are FPSC Level 1® certified, you have to start adhering to the same code of ethics, loyalty and care as a full blown CFP professional does. At this point, you can promote yourself as an FPSC Level 1® cetrificant, and you will be allowed to use the FPSC’s trademarked logo. Furthermore, your name will be included in the FPSC’s CFP Professionals and FPSC Level 1 Certificants directory. As long as you renew your FPSC Level 1® Certification annually, there will be no time limit to proceed forward with the remaining CFP path.

Step 4 is taking an approved FPSC Capstone Course. Here again, FPSC has listed accredited education providers for ease of reference. Once you complete this course, you are all set to write the CFP Exam. There is a maximum window of four years (four attempts) for you to successfully pass the CFP Examination. If you fail to do so, you will have to retake the Capstone Course. The Capstone course can also be completed before writing the FPSC Level 1® Examination.

The next step is writing the CFP Examination. The CFP exam is 6 hours in duration, featuring multiple choice (15-25% of the test) and constructed response (75-85% of the test) questions. The exam can be taken in English and French (upon request). Important dates and exam locations can be found on the link here.

The last step is applying for CFP Certification. After successfully passing the CFP Exam, you will need to obtain 3 years of qualifying full-time work experience. FPSC asks for the qualifying work experience in one of the following areas:

Qualifying work experience needs to be completed no later than 4 years after successfully passing the CFP exam, and the candidate should apply for the CFP certification no later than 8 years after obtaining the work experience.

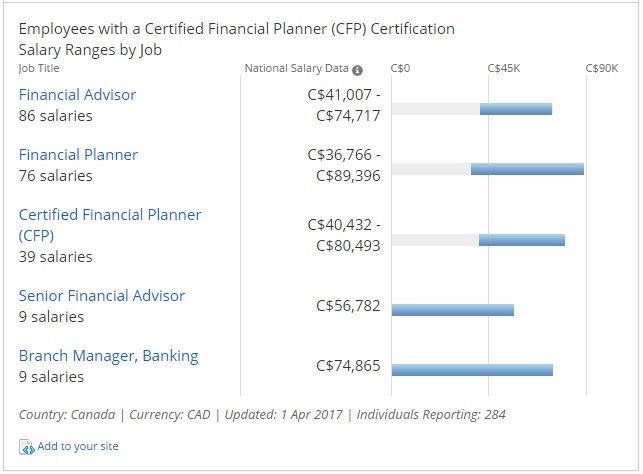

Having obtained the CFP certification not only adds credibility to the practising financial services professional, but can also give a paycheck increase. According to Payscale.com, the average salary for CFP professionals in Canada ranges between CAD 40,432 – CAD 80,493 as of April 2017.

CFP certification requires discipline and dedication. That being said, if you have the passion for digging into financial statements and you take pride in sharing your knowledge with clients and seeing them achieve financial independence, a CFP certification can be an ace up your sleeve.

The information contained in this post is considered true and accurate as of the publication date. However, the accuracy of this information may be impacted by changes in circumstances that occur after the time of publication. Ashton College assumes no liability for any error or omissions in the information contained in this post or any other post in our blog.